portability estate tax return

The estates funds can be used to pay for professional fees. Comptroller of Maryland Estate Tax Section PO.

The Hawaii tax estate tax situation is not so bad.

. Notice to Taxpayer Whose Personal Property Return was Waived in the Previous Year. A Washington estate tax return filing is required if a decedents gross value of all of their property wherever located is over the filing threshold fair market value without any deductions and. The estate and gift tax exemption is 117 million per individual up from 1158 million in.

Property Tax Oversight Forms. If a Washington estate tax return is filed and a Federal estate return is filed a copy of IRS Form 706 must be. To be filed for.

For information on electing portability of the decedents DSUE amount including how to opt out of the election see Part 6 Portability of Deceased Spousal Unused Exclusion. The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. Each estate is entitled to the.

The election to transfer a DSUE amount to a surviving spouse is known as the portability election. The Internal Revenue Service announced today the official estate and gift tax limits for 2021. Each spouse has an exemption amount of 1 million.

Sales and Use Tax. The Estate Tax Without Portability. Surviving spouses may elect to claim any unused portion of their predeceased spouses unused Maryland estate tax exemption under certain.

Assume Bob and Sue are married and all their assets are jointly titled. 2018 legislation established portability for Maryland estate tax purposes. Generation-skipping transfer tax aka GST tax imposes a tax on both outright gifts and transfers in trust to or for the benefit of unrelated persons who are more than 375 years younger than the donor or to related persons more than one generation younger than the donor such as grandchildren.

An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross estate or amount of adjusted taxable gifts. Will Your Estate Owe Estate Tax. Washington law does not have nor does it incorporate the federal provisions of portability for estate tax.

Also on January 2 2013 the American Taxpayer Relief Act ATRA for short was signed. PDF 737 KB DR-405W. Aside from increasing the estate tax gift tax and generation-skipping transfer tax exemptions to 5000000 for 2011 and 5120000 for 2012 this law introduced the concept of portability of the federal estate tax exemption between married couples.

Estate of a citizen or resident of the United States see instructions. Their net worth is 18 million. We also included a pdf download of the Hawaii M-6 estate tax return.

If you are contacted by someone representing themselves as an employee of the Florida Department of Revenuewhether it is by letter or form a phone call or other communicationwho appears unfamiliar with your specific tax or child support account information please feel free to verify their identity by contacting the Departments Taxpayer. Mail the estate tax return and payment to. However Oregons estate tax does not offer portability between spouses.

Tangible Personal Property Tax Return R. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies. Box 828 Annapolis MD 21404-0828.

Your executor will likely have to hire professional help an experienced lawyer or CPA to prepare the Oregon estate tax return. Portability of the estate tax exemption between spouses is not in effect. The Florida Department of Revenues Property Tax Oversight program provides commonly requested tax forms for downloading.

To take advantage of portability both federal and state tax returns must be filed when the first spouse dies. Bob dies first in 2020 and the federal estate tax exemption is 1158. These people are known as skip persons In most cases where a trust.

Irs Says Taxpayers Should Not File Amended Tax Returns Due To Stimulus Law Cpa Practice Advisor

Printable 2019 Irs Form 1040 Us Individual Income Tax Return Cpa Practice Advisor

Taxpayers Should Take These Steps Before Filing Income Taxes Cpa Practice Advisor

Irs Forms 1040 Google Search Irs Tax Forms Tax Forms Income Tax Return

New Irs Requirements To Request Estate Closing Letter

New Jersey Society Of Cpas Reminds Small Business Owners About Tax Saving Benefits Of The New Pass Through Law Cpa Practice Advisor

Distributable Net Income Tax Rules For Bypass Trusts

Irs To Dispose Of Older Estate Tax Returns Wealth Management

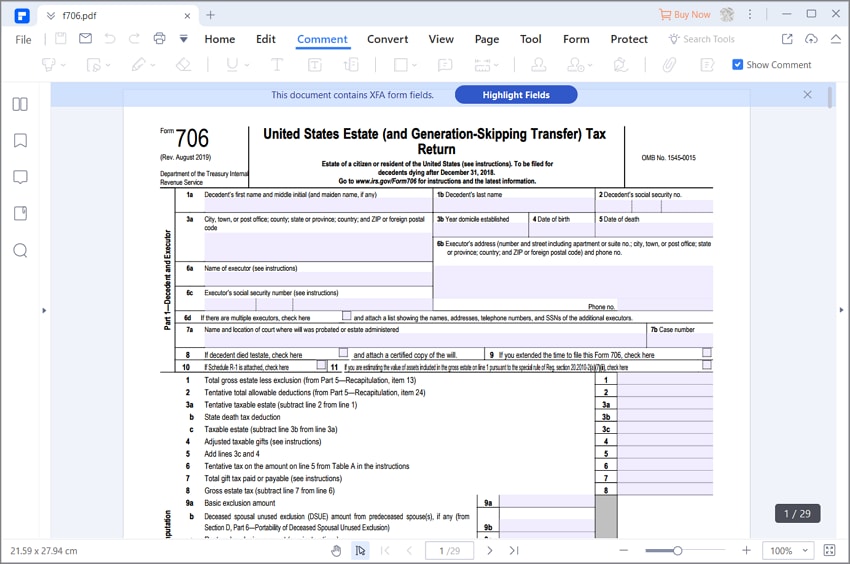

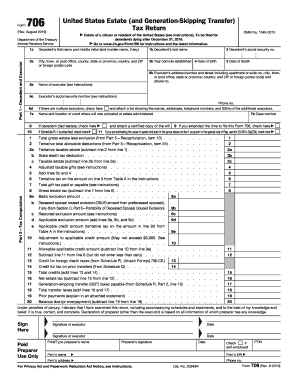

Federal Estate Tax Return Irs Form 706

For How To Fill In Irs Form 706

June 2016 Trust Me I M A Lawyer

Special Rule Of Regulations Section 20 2010 2 A 7 Ii Trust Me I M A Lawyer

An Overview Of Estate Tax Portability Provisions Aicpa Insights

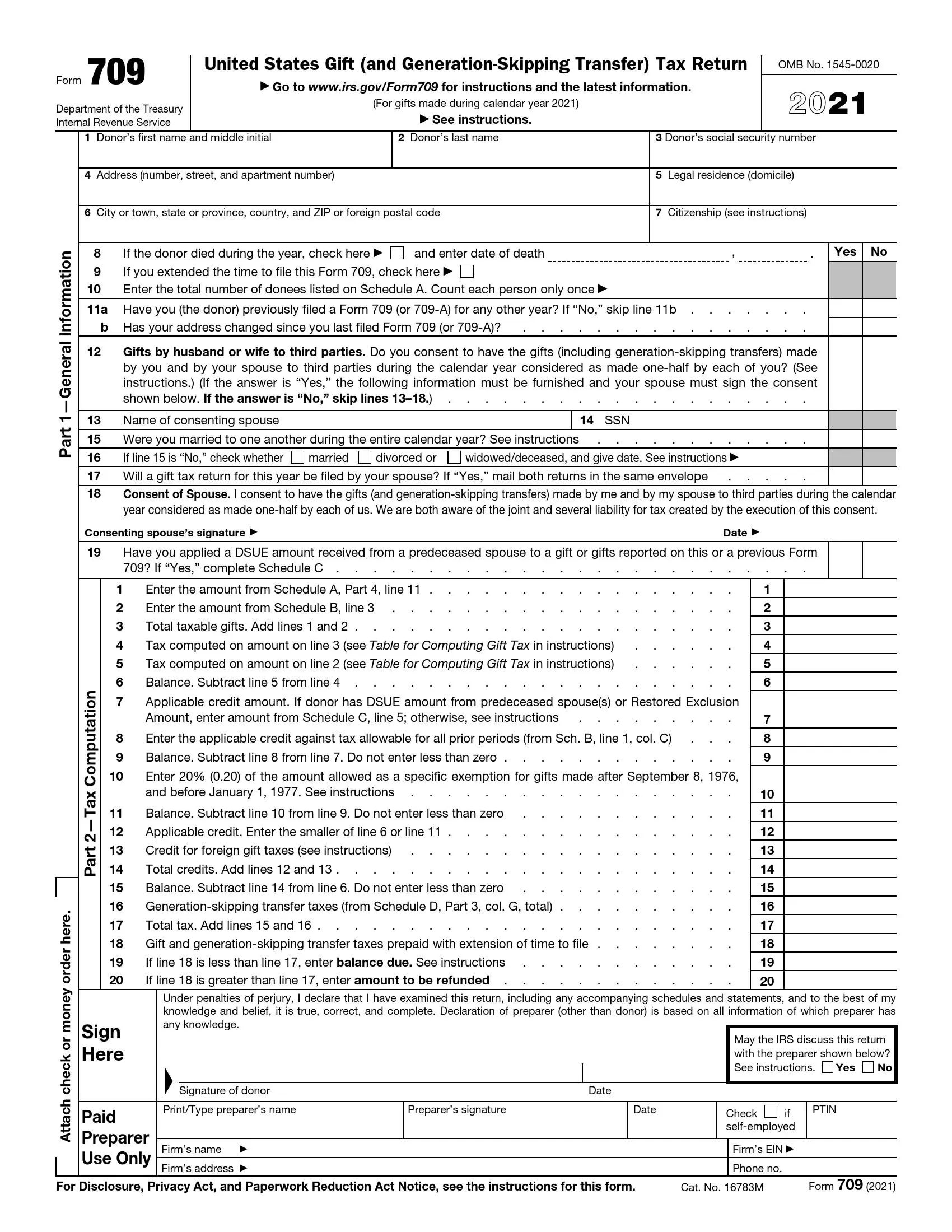

Irs Form 709 Fill Out Printable Pdf Forms Online

Deceased Spousal Unused Exclusion Dsue Portability

Your Beloved Spouse Just Died How To Deal With The Estate Tax Reporterwings

Irs Form 706 Fill Out And Sign Printable Pdf Template Signnow