pittsburgh pa local services tax

RATE OF TAX 52 A person subject to the Local Services Tax shall be assessed a pro rata share of the tax for each payroll period in which the person is engaging in an. TREASURER CITY OF PITTSBURGH DO NOT SEND CASH Mail to.

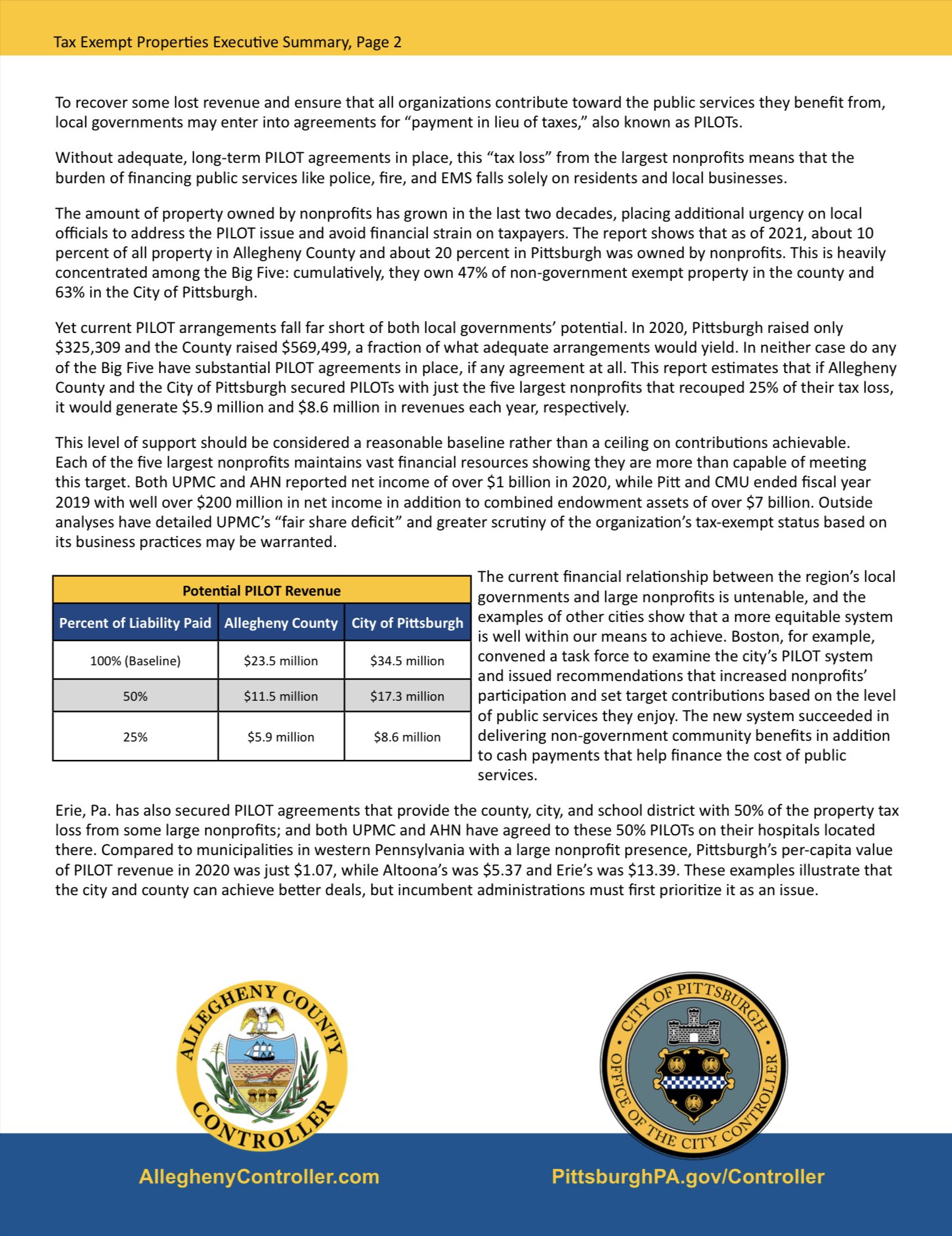

Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that.

. Tax rate for nonresidents who work in Pittsburgh. Pennsylvania law limits total payment by one person to a maximum of 5200 per year regardless of the number of. The most current name is the Local Services Tax.

Local Services Tax to the City of Pittsburgh. 1405 North Duke Street PO Box 15627 York PA. PENALTY Penalty per month.

Annual Tax Levied The Local Services Tax remains a flat 52 tax levied annually on all persons engaging in an occupation within the geographic boundaries of the Borough including self. York Adams Tax Bureau. Offers comprehensive revenue collection services to all.

414 Grant Street City State Zip. LST Exemption Certificate City of Pittsburgh Department of Finance Address. City 1 School district 2.

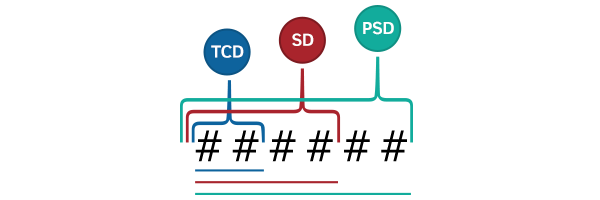

PSD Codes play an integral role in assisting employers and tax collectors to remit and distribute the correct amount of local Earned Income Tax to the correct taxing jurisdictions. YORK TAX COLLECTION DISTRICT. Make check payable to.

Local Services Tax is 5200 per person per year payable quarterly. Jordan Tax Services is the agent for EIT Tax collection for the Allegheny County Central Tax District. JORDAN TAX SERVICE INC.

50 North Seventh Street Bangor PA 18013. Employee must show proof that 10 was withheld the rate of the Local Services Tax is 52 for Pittsburgh. The City of Pittsburgh provides certain tax exemptions and discounts on City real estate tax.

Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the. For Directions click Here. A Local Services Tax is.

This tax was previously called the Occupational Privilege Tax OPT and the Emergency Services Tax EMS. City of Pittsburgh residential. LOCAL SERVICES TAX AMOUNT 2.

Jordan Tax Service Inc. Due to the separate billing of the Parks Tax the discount and tax exemptions. CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476 A 3000 fee will.

LOCAL SERVICES TAX IS 5200 PER YEAR - 1300 PER QUARTER. If the employee works the. INTEREST Interest per month 1 001 3.

COVID-19 Working from Home Local Services Tax and Payroll Tax Policy If the employer offers the employee space at an office location in the City of Pittsburgh that location should be.

Dosh Relocating To Pittsburgh Pittsburgh Taxes Dosh

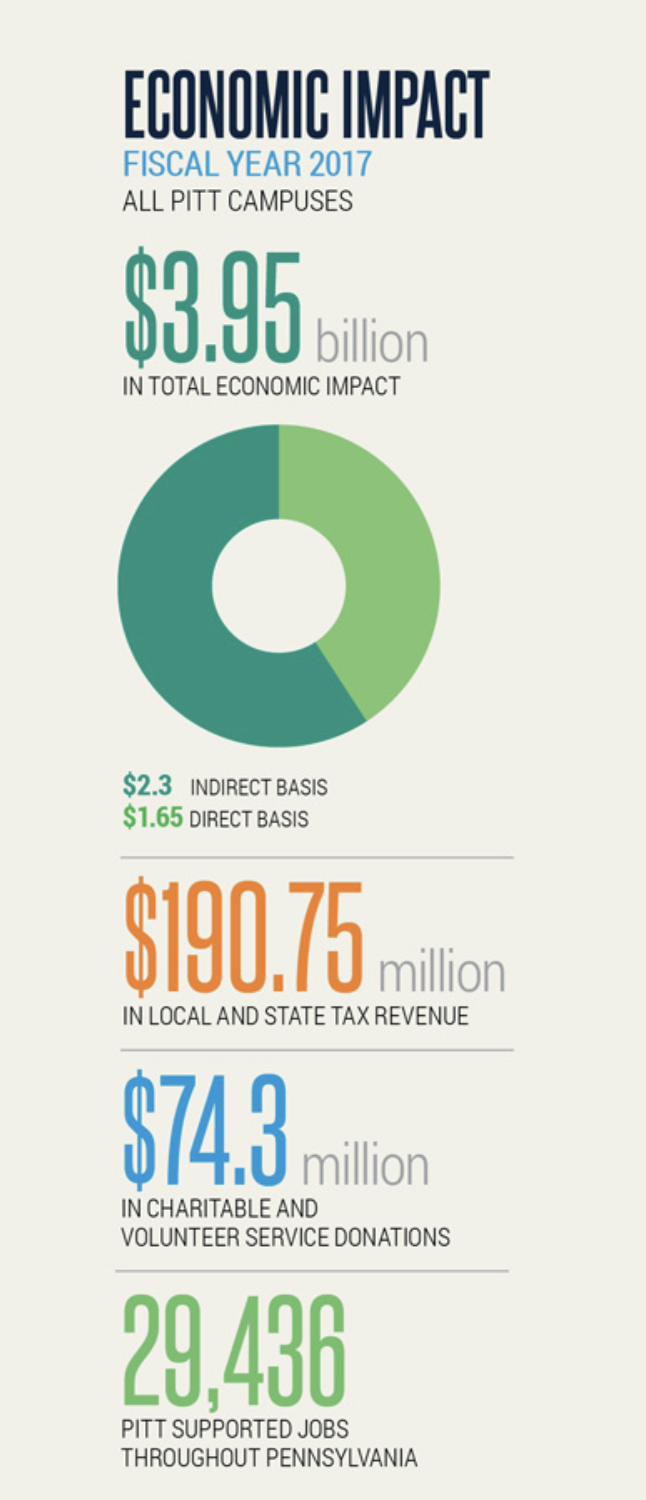

Pitt S Economic Impact For Fiscal Year 2017 Pittwire University Of Pittsburgh

Enjoy Coupon Book 2023 Ross Township Pa

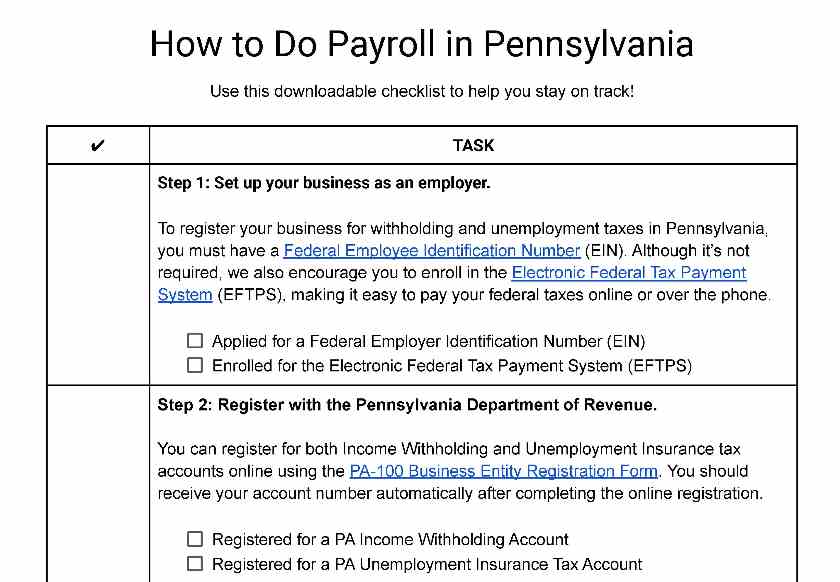

How To Do Payroll In Pennsylvania What Every Employer Needs To Know

Pennsylvania Payroll Services And Regulations Gusto Resources

Residency Certification Form Local Earned Income Tax Withholding

Pittsburgh Schools To Challenge Ruling On Tax Rate Decrease In County Property Assessment Appeals Pittsburgh Post Gazette

Local Services Tax Springfield Township

Delta Phi Sigma Chapter Of Sigma Gamma Rho Sorority Inc Pittsburgh Pa Home Facebook

Office Of The City Controller Pghcontroller Twitter

Jordan Tax Service Pittsburgh Fill Online Printable Fillable Blank Pdffiller

Pennsylvania Sales Tax Guide For Businesses

Local Pennsylvania Pittsburgh Seniors Blue Book

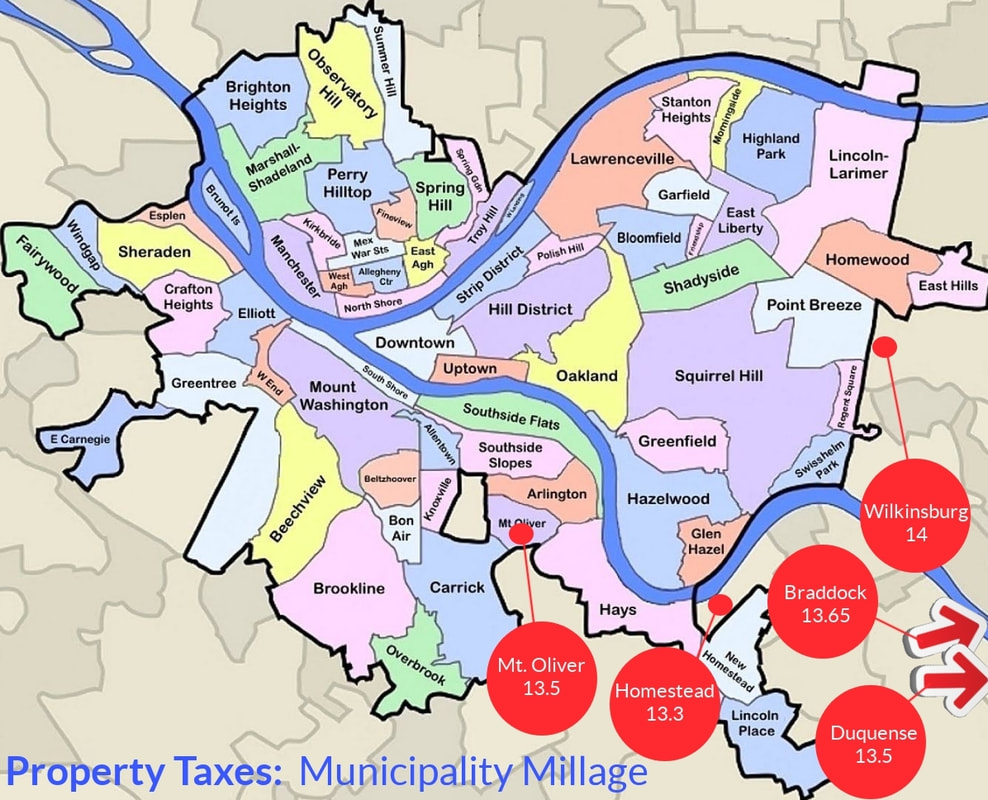

A Guide To Pennsylvania Property Tax By Jason Cohen Pittsburgh Pittsburgh Pa Patch

Jackson Hewitt Tax Service 3022 Banksville Rd Pittsburgh Pa Yelp